In our fast-paced, modern world, how many people have time to write down their monthly or annual expenses in a notebook? Everyone uses online solutions to make their expense tracking easier. Thanks to technological advances, mobile apps have emerged as the perfect companion for today’s generation. This has also led to expense-tracking apps that are booming across the sector.

It is a vital element of business or personal financial management. Keeping track of expenses using pencil and paper is the old-fashioned way. Thanks to technological advancements, expense-tracking apps have made it much easier to track spending.

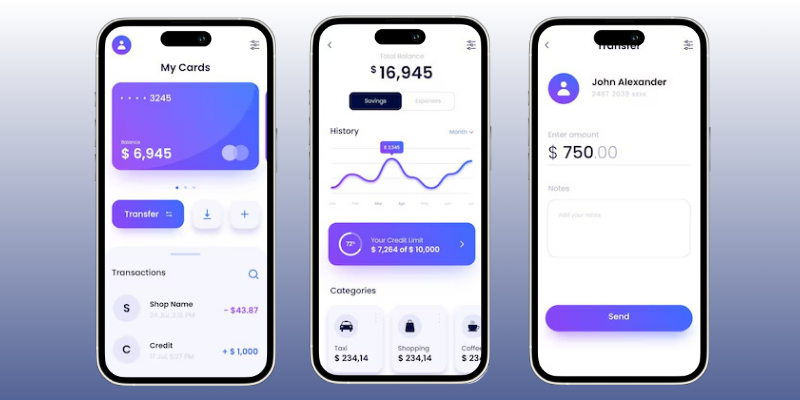

Smartphone apps for tracking expenses allow users to manage expenses, income, and budgets. These apps come with a range of features that make it simple to track expenses and develop a budget. In this article, we will examine the costs involved in personal expense tracker app development and the features that are typically offered in these applications.

Must-Have Features in a Money Tracking App

Before searching for a reliable expense management app development company, create a list of functions and features you require for your expense management software.

We have developed the below list of features every app for managing expenses should include:

Data Protection

Security is the primary consideration for anyone who has access to sensitive data. App developers must prioritize this aspect.

The security of an app for tracking expenses must be at the top of its game at all times. If the phone or tablet is stolen, then the application must be able to retrieve the information on the account.

Report Generation

Users will be able to produce financial statements, including profit and loss reports, reports on income and expenditures, and other reports.

Additionally, users can use this function to generate preliminary budgetary or inventory management reports.

Receipt Management and Organization

If a person is late on the transaction, this function compensates for the loss. If a user receives or makes money online, they only need to take an image of their receipt.

Apps for tracking expenses must remind users to place the costs in the appropriate category to prevent them from forgetting.

Also, it’s safe to assume they won’t lose these photos because they’re kept in the cloud.

Efficient Ways to Reduce Taxes

If you have to pay taxes, the expense tracking software can make it easier for them to submit their taxes. Spending and income could be classified using tax-friendly methods.

Utilizing expense management software, businesses can monitor their earnings and expenses.

Invoices and Bills

An app should back up online banking, bank transfers, UPI payments, and card transactions and track expenses. Reports and invoices are, therefore, tracked inside the app itself.

Manages Inventory

Stock management doesn’t require the development of unique software. It can perform this job.

For example, when a product’s stock is running low, expense management software could inform the user and notify the user accordingly.

Streamlines Operations

Automating the creation, distribution, and reviewing of reports is a significant benefit of this software.

Users can evaluate notifications based on the needs of their enterprise applications. Automated notification strengthens customer relations and improves the flow of cash and sales.

AI-based Robo-Advisors

Virtual financial advice is now feasible because of an AI-powered function. This function also creates algorithmic portfolios for investment and analyzes monitoring, enhancing, and assessing diversifying investment options.

Clients’ financial status or future plans are usually collected to provide information on how to make financial choices.

Robo-advisors provide recommendations in a snap, and new investors can trade in real-time without losing money.

Monitor Credit Score

This feature shows daily and weekly credit scores along with an overall fair or reasonable score for each user.

Your customers will receive personalized push notifications and suggestions based on their current credit scores, along with details on how to improve their credit scores.

Make Small Investments

This feature allows users to invest small amounts of money instead of worrying about making larger purchases, which could be difficult.

Investing can be scheduled monthly or per account based on the balance.

AI-Driven Chatbots

It’s wonderful to integrate virtual assistants in expense tracking app development solutions who interact with your customers and keep them happy. In terms of answering questions, they can be virtual assistants who provide all the answers for users.

Offers and Discounts

This way, users can save money by receiving discounts on things they’d like to purchase.

It also identifies and offers special discounts on products people want to purchase or provides cheaper replacements for the same item at the purchase date.

Saving money is much easier when you use an app to track expenses. These apps provide users with information on where and how to cut costs.

Keeping Track of Travel Money

This feature could be integrated into the expense tracking software so that employees can make a budget before embarking on business trips.

The user can enter the location via the search box and get an appropriate chart to meet their preferences. Users can then assign resources based on the estimated travel expenses. This could save significant money, which would otherwise be used for business travel.

Contracts with Suppliers

The app can input information about the vendor and their classifications to track expenses. Additionally, users can keep track of each payment made, including the amount and who made it.

Budget Monitoring

Tools for monitoring expenses will help anyone understand the gap between income and spending. Users must be able to see the entire picture and gain valuable insights.

This is why having real-time information on investments and budgets is crucial. Furthermore, the mobile app can assist people in sticking to a budget and generate options like cutting down on unnecessary expenses.

Safe and Secure Access

Making payments trackable on your own can be difficult. Experienced app developers and companies can give their customers security in accessing their funds and provide their users with a smooth experience.

Expense tracking software allows you to improve the efficiency and understanding of the team in general. Ultimately, it’s the best way for businesses to exchange information with the team than by using this application.

AI-based Projections

Artificial intelligence can be aware of your spending habits and financial status and can, therefore, predict future purchases. Additionally, it offers specific tips on how to save money.

With the feature, everything that users must be aware of all the expense management app development services regarding budgeting, from the amount to spend to the best place to spend it, could be integrated into an app for tracking expenses.

Cost of Expense Tracking App Development

The development of an app requires thorough market research that can assist you in understanding the essential elements of costing. The price of creating an app to track expenses depends on a few important factors. These variables gradually impact the development of an app for tracking expenses. We’ll discuss these aspects later in the discussion, but first, we will look at the cost.

Therefore, the price of app development that is expense-tracking begins at $5,000 and can increase to $50,000 or $90,000 based on your requirements. Let us outline what you need to know based on the expense of developing apps.

An expense tracking app’s primary cost ranges between $5,000 and $8,000, and you’ll get all the functional features you need for your venture. Furthermore, a basic expense tracking application with features costs $10,000 to $15,000 and includes all the features you need to run your business effectively. The price for an expensive feature-pack expense tracking application development ranges from $20,000 up to $40,000, and it can increase to $50,000.

The costs we’ve presented here need to be more accurate. They are just estimates of the amount that developing an app for tracking expenses might cost. In addition, as we said previously, the expense of creating an expense-tracking app entirely depends on your needs and the structure of your project. Find out the factors that influence app development prices for expense tracking.

Conclusion

To fully comprehend the complicated world of app development costs, you must consider a variety of aspects that impact the cost. This will help you identify effective methods to cut costs. It’s a long and difficult journey that requires crucial choices. The main takeaway is that although there’s no universal answer for what it costs to develop an app, well-planned planning, and strategic decision-making can result in a profitable and cost-effective development project for your app.

At JPLoft, we are aware of the challenges and complexities. Our team is dedicated to helping you navigate each phase of the mobile application development process. Our expertise allows us to create quality, cost-effective, and efficient applications designed to meet your specific requirements. We offer reasonable prices while maintaining the highest quality.