In today’s fast-paced business competition, efficiency is key to success. When it comes to payroll tax reporting, electronic filing software offers you a streamlined solution to save time, reduce errors, and ensure compliance with tax regulations. However, with various options available in the market, choosing the right electronic filing software for your business can be a confusing task. Read through this article, to learn how businesses can maximize efficiency with electronic filing software to File 941 Online and provide guidance on selecting the right solution for their needs.

What is IRS Form 941?

Form 941 (Employer’s Quarterly Tax Return) is an essential tax form used by employers to report Federal income taxes, Social Security, and Medicare taxes withheld from an employee’s paycheck.

Note: Employers are required to file 941 even when there are no wages to report, no tax liabilities, and no adjustments to previous tax deposits for a specific quarter. This scenario is known as Zero tax reporting on Form 941.

Who Must File Form 941?

Employers or business owners who pay wages to an employee must report the taxes withheld by Filing Form 941 every quarter.

Exceptions from Filing 941:

Employers falling under the following categories are excluded from filing Form 941.

- Seasonal business employers

- Employers of household employees

- Employers of farm employees

What’s New in Form 941 for the 2024 Tax Year?

- The Social Security wage limit has been increased from $160,200 to $168,600 in 2024.

- Social Security & Medicare taxes are applied to household workers who get paid $2,700 or more and Election workers who get paid over $2,300 or more.

- Businesses can no longer claim COVID-19-related credits on Form 941.

- New Spanish Form 941 (sp) has been introduced, enabling employers in the U.S territories to file their returns in Spanish. On the other hand, Form 941-SS and 941-PR are discontinued.

What is the deadline for filing Form 941?

The due date to File Form 941 for every quarter is as follows:

- Quarter 1 – April 30, 2024

- Quarter 2 – July 31, 2024

- Quarter 3 – October 31, 2024

- Quarter 4 – January 31, 2025

Note: Form 941 Schedule B is accompanied by Form 941, used by the Semiweekly schedule depositors to report the federal income tax withheld from the employees as well the employer’s share of social security and Medicare taxes for the period.

Employers who fall under these tax liability categories should use Form 941 Schedule B:

- Reported more than $50,000 of employment taxes in the lookback period.

- Accumulated a tax liability of $100,000 or more on any given day in the current or prior calendar year.

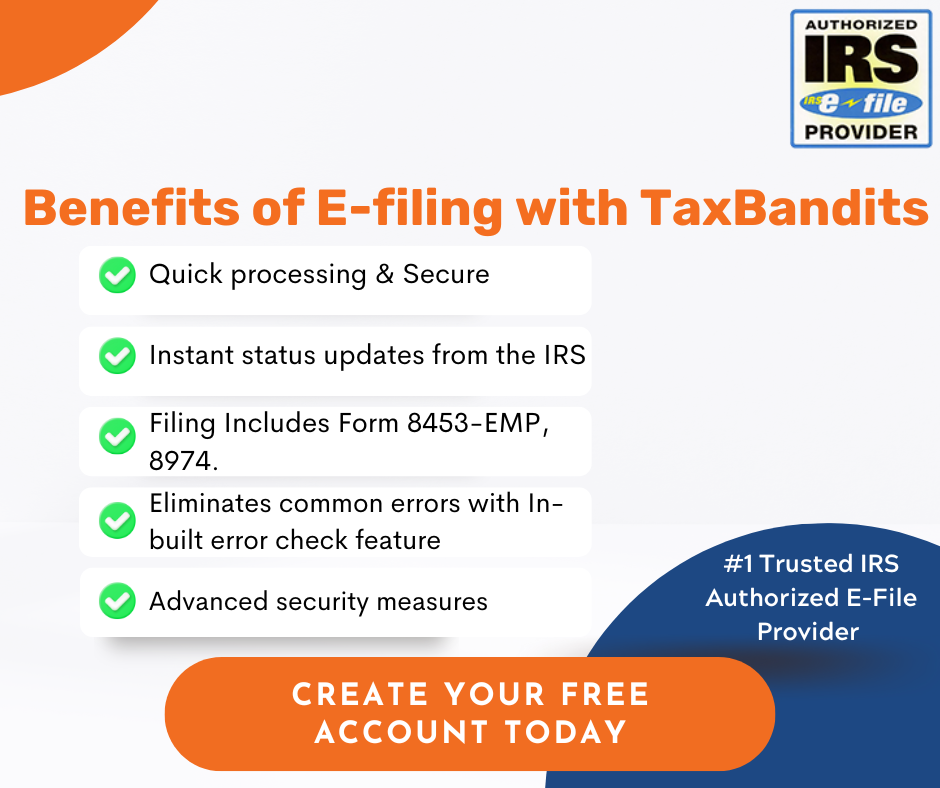

While there are many electronic filing software options available, TaxBandits stands out to be the best E-File Provider, serving their solution to a wide range of audiences.TaxBandits provides a streamlined Filing solution to Business Owners, CPAs, Reporting Agents, EROs, and Enterprises. It makes its users unique from the rest, with its standalone features which make their filing journey simple and secure.

TaxBandits, an IRS-authorised e-file provider is the best solution to File your Form 941 online.

- Secure Filing and get Instant IRS Updates

- Supports 941-PR, 941-SS, 941-SP, and 941 Schedule R

- Bulk Upload Templates to Upload Form Data

- Supports Prior year tax filings

- API Solution for Service Providers

Visit https://www.taxbandits.com/payroll-forms/e-file-form-941-online/ to learn more about How to E-File 941 in just 3 simple steps.