“Energy Trading and Risk Management (ETRM) Market to Surpass USD 68.2 Billion by 2034: Key Trends, Challenges, and Strategic Insights”

Introduction

In an era marked by volatile energy prices, regulatory complexities, and the global shift toward renewable sources, the importance of effective Energy Trading and Risk Management (ETRM) systems has never been more pronounced. These sophisticated platforms enable energy companies to navigate the intricate landscape of trading activities while mitigating associated risks.

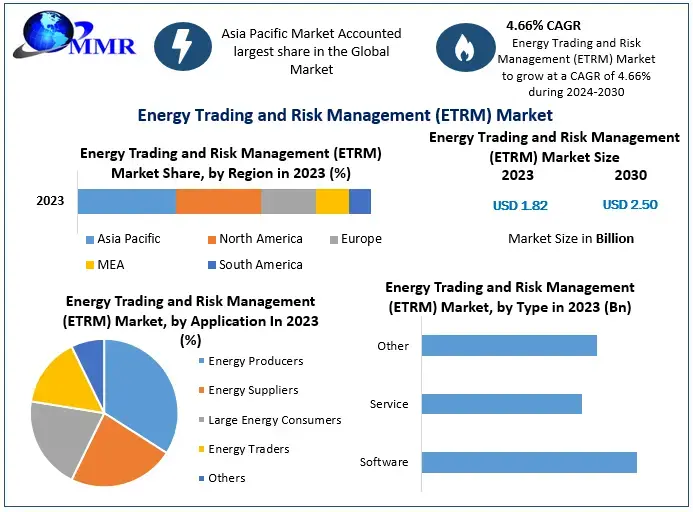

As of 2023, the global ETRM market was valued at USD 37.4 billion and is projected to grow at a CAGR of 4.9%, reaching approximately USD 68.2 billion by 2034 . This article delves into the pivotal factors driving this growth, the challenges faced by the industry, and the strategic opportunities that lie ahead.

Understanding ETRM Systems

Energy Trading and Risk Management (ETRM) Market systems are integrated software solutions designed to support the trading of energy commodities—such as electricity, natural gas, crude oil, and renewables—while managing the financial and operational risks inherent in these markets. Key functionalities include:

-

Trade Capture and Management: Recording and overseeing trading activities across various markets and commodities.

-

Risk Analysis: Assessing market, credit, and operational risks to inform decision-making.

-

Regulatory Compliance: Ensuring adherence to evolving energy regulations and reporting requirements.

-

Settlement and Accounting: Streamlining financial transactions and accounting processes related to energy trades.

Curious about the market dynamics? Get a free sample to explore the latest insights here:https://www.maximizemarketresearch.com/request-sample/70529/

Market Dynamics Driving Growth

1. Transition to Renewable Energy Sources

The global push for cleaner energy has led to increased integration of renewables into the energy mix. This transition introduces variability and complexity in energy trading, necessitating advanced ETRM systems to manage intermittent supply and demand patterns .

2. Regulatory Evolution

Governments worldwide are implementing stringent regulations to promote transparency and sustainability in energy markets. ETRM systems play a crucial role in helping companies comply with these regulations by providing detailed reporting and audit trails.

3. Technological Advancements

The incorporation of Artificial Intelligence (AI) and Machine Learning (ML) into ETRM platforms enhances predictive analytics, enabling more accurate forecasting of market trends and risk assessment.

4. Market Volatility

Geopolitical tensions, such as trade wars and sanctions, contribute to price volatility in energy markets. ETRM systems equip companies with tools to hedge against such uncertainties and protect profit margins .

To Gain More Insights into the Market Analysis, Browse Summary of the Research Report:https://www.maximizemarketresearch.com/market-report/energy-trading-and-risk-management-etrm-market/70529/

Challenges in the ETRM Landscape

Despite the promising growth, the ETRM market faces several challenges:

-

Integration Complexity: Merging ETRM systems with existing IT infrastructure can be complex and resource-intensive.

-

High Implementation Costs: The initial investment for ETRM solutions can be substantial, particularly for small to mid-sized enterprises.

-

Data Management: Handling vast amounts of data from diverse sources requires robust data governance and security measures.

Regional Market Insights

North America

Leading the ETRM market, North America benefits from a mature energy sector and early adoption of advanced trading systems. The region’s focus on shale gas and renewable energy sources drives the demand for sophisticated ETRM solutions.

Europe

Europe’s commitment to carbon neutrality and the integration of cross-border energy markets necessitate comprehensive ETRM systems to manage complex trading and compliance requirements.

Asia-Pacific

Rapid industrialization and urbanization in countries like China and India are expanding energy markets, creating opportunities for ETRM system adoption to manage growing trading activities.

Key Players in the ETRM Market

Prominent companies shaping the ETRM landscape include:

-

Allegro Development Corporation

-

Triple Point Technology Inc.

-

Openlink LLC

-

SAP SE

-

Eka Software Solutions

-

Accenture

-

Sapient

-

Ventyx

-

Trayport

These organizations offer a range of solutions catering to various segments of the energy trading market, from large utilities to niche commodity traders.

Strategic Opportunities

To capitalize on the evolving ETRM market, companies should consider the following strategies:

-

Cloud-Based Solutions: Transitioning to cloud-based ETRM systems can offer scalability, reduced costs, and enhanced accessibility.

-

Customization: Tailoring ETRM solutions to specific organizational needs ensures better alignment with business objectives.

-

Continuous Training: Investing in employee training ensures that staff can effectively utilize ETRM systems to their full potential.

-

Collaborative Partnerships: Engaging with technology partners can facilitate the integration of innovative features and keep systems up-to-date with market demands.

Conclusion

The Energy Trading and Risk Management market stands at a pivotal juncture, driven by the global energy transition, regulatory changes, and technological advancements. Organizations that proactively adopt and adapt ETRM systems will be better positioned to navigate the complexities of modern energy markets, mitigate risks, and capitalize on emerging opportunities.