Are you struggling to remove payroll liabilities from QuickBooks? Look no further, as we’ve got you covered!Handling payroll liabilities can be a complex and time-consuming task, but with the right knowledge and resources, you can easily navigate through the process.

We will walk you through each step, from identifying payroll liabilities to making adjustments in your QuickBooks account.

Whether you’re a small business owner or an accounting professional, understanding how to remove payroll liabilities from QuickBooks is essential for maintaining financial accuracy and compliance.

By following our expert advice and utilizing the features available in the software, you can streamline your payroll processes and avoid any potential errors or penalties. Ready to take control of your payroll liabilities in QuickBooks? Let’s get started on this step-by-step journey together.

Understanding Payroll Liabilities in QuickBooks

Payroll liabilities in QuickBooks are amounts owed but not yet paid to employees or government agencies. These can include wages, payroll taxes, and contributions to employee benefit programs. It’s crucial to accurately track and manage these liabilities to maintain financial stability and compliance.

Identifying these liabilities within QuickBooks is the first step toward managing your payroll effectively. The software categorizes these under the broader umbrella of liabilities, distinguishing them for ease of access and adjustment. Knowing where these figures are housed in your QuickBooks dashboard is essential for the steps that follow.

Without a proper understanding of payroll liabilities and where they reside in your accounting software, it becomes challenging to manage your finances efficiently. QuickBooks provides a structured way to navigate through these, ensuring that you can pinpoint and address any issues without delay.

Common Payroll Liabilities and Their Implications

Payroll liabilities are not just numbers on your balance sheet;

they represent actual debts that can have significant implications if not managed properly. Common payroll liabilities include federal and state taxes, Social Security, Medicare, and employee benefits such as health insurance or retirement contributions.

The implications of not accurately handling these liabilities extend beyond just financial inaccuracies. They can lead to penalties from tax agencies, disgruntled employees, and a tarnished reputation. This underscores the importance of keeping your payroll liabilities in check and ensuring they are correctly recorded in QuickBooks.

In addition to the direct financial implications, mismanagement of payroll liabilities can also lead to a loss of trust. Employees and regulatory bodies need to know that a business is handling its financial obligations correctly. Failure to do so can result in audits and investigations, adding to the stress and financial strain.

Steps to Remove Payroll Liabilities in QuickBooks

The process of removing payroll liabilities from QuickBooks involves several key steps, starting with setting up liability accounts. If you’re new to QuickBooks or haven’t yet established how your payroll liabilities are categorized, this is a crucial first step.

QuickBooks allows for the creation of specific accounts for different types of liabilities, making it easier to manage and ultimately remove them. Recording payroll liabilities accurately in QuickBooks is essential. This involves not just entering amounts but ensuring they are allocated to the correct periods and categories.

Mistakes in recording can lead to discrepancies that are difficult to untangle. Regularly updating these entries ensures that when it comes time to remove liabilities, the process is straightforward.

Adjusting payroll liabilities in QuickBooks may be necessary from time to time. This could be due to errors in recording, changes in tax rates, or adjustments to employee benefits. QuickBooks provides tools for making these adjustments, ensuring that your liabilities are always accurate and up-to-date.

Best Practices for Managing Payroll Liabilities in QuickBooks

To streamline the process of managing and removing payroll liabilities in QuickBooks, it’s beneficial to adopt a set of best practices. Regularly reviewing your payroll liability accounts ensures that you catch and correct any errors promptly. This proactive approach can save time and prevent issues from escalating.

Another best practice is to utilize the reports feature in QuickBooks. These reports can provide insights into your payroll liabilities, helping you to identify trends, forecast future payments, and ensure that all liabilities are accounted for and properly managed.

Lastly, staying informed on changes in tax laws and payroll regulations is crucial. These changes can directly impact your payroll liabilities, and staying ahead means you can adjust your QuickBooks records accordingly, ensuring compliance and accuracy.

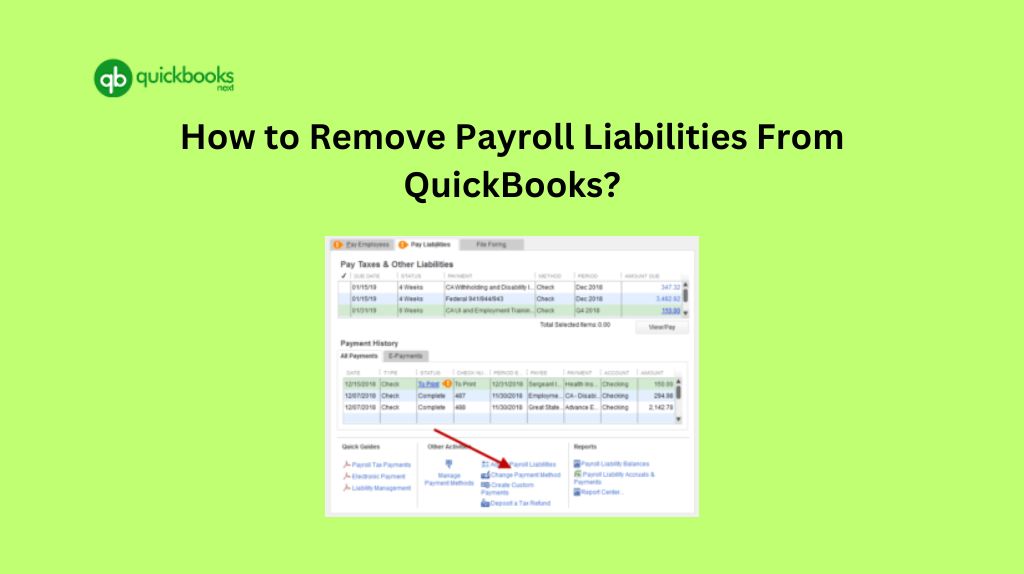

How To Adjust Payroll Liabilities in QuickBooks?

To adjust payroll liabilities in QuickBooks, adjust payroll liabilities in QuickBooks, follow these steps:

- Go to the Employees menu.

- Select Payroll Taxes and Liabilities.

- Choose Adjust Payroll Liabilities.

- Enter the adjustment date and effective date (usually the last paycheck date of the affected month or quarter).

- Select “Employee Adjustment” and choose the employee’s name.

- Pick the payroll item you need to adjust from the Item Name column.

- Enter the adjustment amount (positive for under-withheld, negative for over-withheld).

- If needed, enter an amount in the Income Subject to Tax column for wage base adjustments.

- Add a memo for reference.

- Select the appropriate accounts to be affected.

- Review the information and click OK to save the adjustment.

After making adjustments, run payroll reports or check liability balances on the balance sheet to verify the changes. This process helps correct discrepancies in your payroll liabilities, ensuring accurate financial records and tax submissions.

Conclusion

Removing payroll liabilities from QuickBooks doesn’t have to be a daunting task. With a clear understanding of what payroll liabilities are, how to record them, and the steps for adjustment, you can ensure your financial records are accurate and up-to-date.

Remember, the key to successfully managing payroll liabilities in QuickBooks lies in regular review, accurate recording, and staying informed on regulatory changes. With these practices in place, you can take control of your payroll liabilities and focus on growing your business.

Such relevant and timely content sosrotogel