New PAN Card 2.0 with QR Code to Be Issued to Taxpayers — Charges Explained

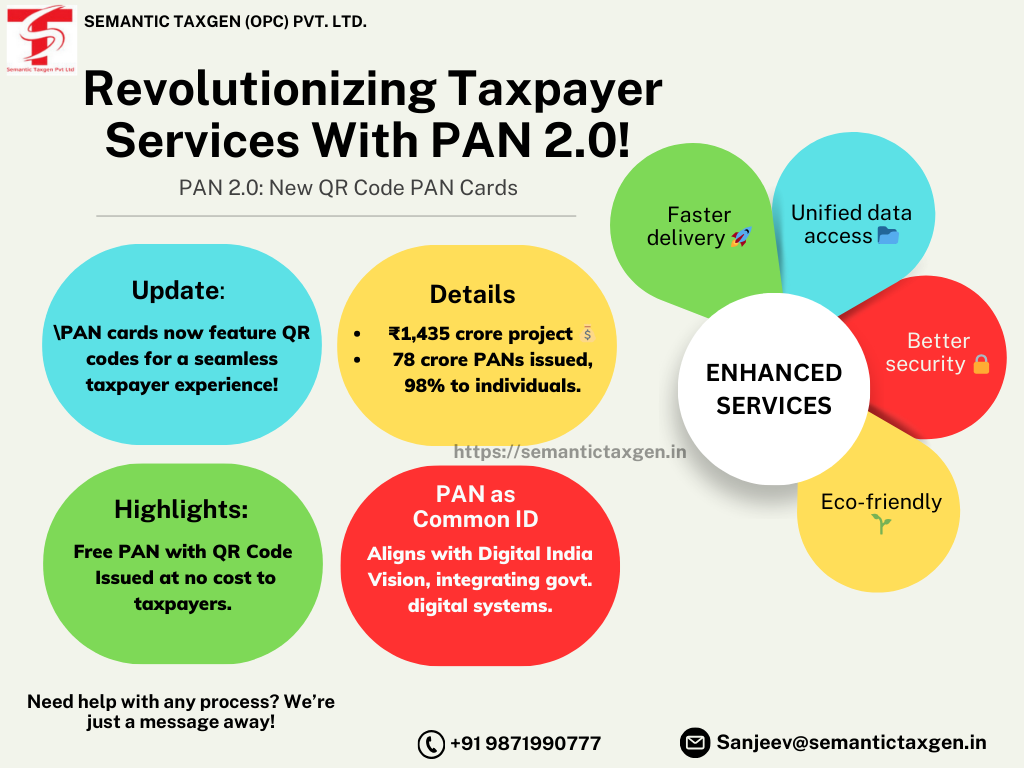

The Permanent Account Number (PAN) card is a ten-digit alphanumeric number, issued in the form of a laminated card, It is a crucial document for taxpayers in India, serving as a unique identifier for financial and tax-related transactions. The Income Tax Department has recently announced an update to the PAN card format. A new version of the PAN card, featuring an embedded QR code, will soon be issued to taxpayers. Here’s everything you need to know about this update, including charges and benefits.

What Is the New QR Code on PAN Card 2.0?

The updated PAN card 2.0 will include a QR code that carries essential information about the cardholder. This QR code will store data such as the individual’s name, date of birth, and PAN number. It will allow for easy and quick verification of details, ensuring accuracy and minimizing fraud risks.

The QR code is designed to provide a tech-savvy solution for identity verification, enabling authorities and financial institutions to authenticate PAN cardholders with just a scan.

Why the Update?

The initiative to include QR codes on PAN cards is part of the government’s ongoing efforts to modernize documentation and improve transparency in financial transactions. By adopting digital solutions, the Income Tax Department aims to streamline processes, reduce paperwork, and enhance the overall efficiency of tax administration.

How to Get the Updated PAN Card 2.0?

If you’re looking to update or reprint your PAN card with the new QR code, here’s how you can do it:

- Visit the Official NSDL or UTIITSL Website:

- Go to the NSDL e-Gov PAN services or UTIITSL portal.

2. Apply for PAN Reprint or Update:

- Select the “Reprint PAN Card” option for existing users.

- For new applicants, fill out the necessary details under the “Apply for PAN Card” section. Learn More: