Money is vital, and growth is called compounding. Yes, that is true. No matter who you are or where you are, you need to manage your finances to live freely. Moreover, there are many ways you can learn to manage it. One of them is your academic project. Yes, you heard it right. It might sound impossible, but one can boost knowledge by writing a document. However, one can take a finance assignment help if one happens to face trouble in jotting the pointers. Besides, this article is all about remarkable concepts you can learn from finance assignments.

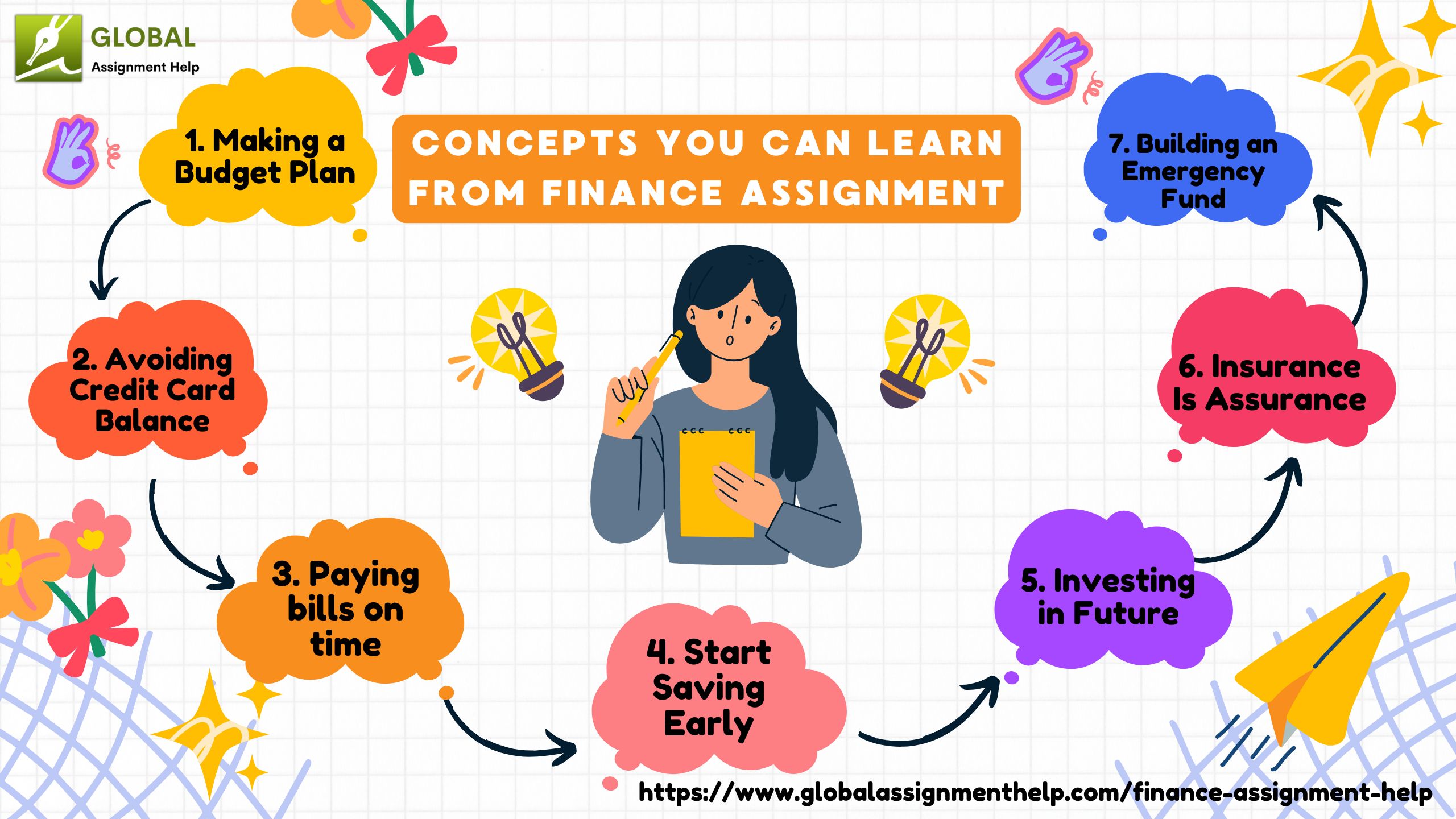

Here’s What You Can Learn From Your Finance Assignment

This write-up is all about beginners facing issues in managing money. You can learn a lot about monetary uses from your finance project to implement in your daily life. Starting with budget, this article will cover all the basic awareness pointers one must know to understand finance in detail.

Making a Budget Plan

One of the crucial elements of life you can learn from your project is budgeting. It plays a vital role in managing expenses and income. Moreover, one should always be sure of what’s going out of an account to keep track of what’s coming in. Also, you can quickly handle your finances just by going through your old statements from the past.

Avoiding Credit Card Balance

It’s very easy to get a credit card in this digital era of payment. Kids these days own assets on credit and end up misusing them. It is because when you have the leverage of spending more than you can afford, it can be tempting. But, little do people realize, carrying a balance from month to month can make those purchases more expensive due to high interest rates. To include this detail in your project successfully, in your task, you can seek guidance from trusted assignment help experts.

Paying bills on time

Procrastination is a common trait of all. Most people delay their payments because they think it could be done later. Furthermore, it leads to poor financial management and inaccurate bills. Moreover, if one misses a payment, the creditor might impose penalties on the same. Hence, it is vital to keep track of transactions to avoid paying interest and manage money control.

Start Saving Early

When you are young, it is vital to save and invest. Yet, it may feel that your retirement is a far-fetched dream, it is not harmful to keep some money aside. The biggest reason to start saving early is to understand the power of compounding. The more you invest, the greater the chances of getting incremental returns. You can learn all of this from writing your finance project.

Investing in Future

In addition to the above point, investing is about saving some portion of your income in stocks or equity. However, you might want to invest in long-term capital; it is crucial to be aware of risks added to the same. To start investing, you can trust your money in small-cap companies. It might give you fewer returns but is safe and flexible for newbies to learn.

Insurance Is Assurance

God forbid, but nobody knows what will happen the very next moment. So, it is better to be ready for the worst. This means making sure you have health, car, and other vital insurance plans for the future. Moreover, you should also consider homeowners insurance to protect your place and its assets.

However, it is advisable to consult different firms before choosing one.

Building an Emergency Fund

A savings fund or an emergency piggy bank is always advisable by most financial advisors. It is vital to make one for future scenarios. In simple words, you never know what will occur. And so, it becomes crucial to save up for the time of necessity.

Conclusion

In conclusion, being good with money requires basic skills that most people never get taught in school. Learning personal finance is always beneficial and is one of the vital factors of being an adult. However, when writing a finance project, it is crucial to add some fundamental concepts. You can take a finance assignment help if you face any trouble regarding the inclusion of content. Hopefully, you would have gotten the gist of managing spending and earnings to safeguard the future for yourself and your loved ones.