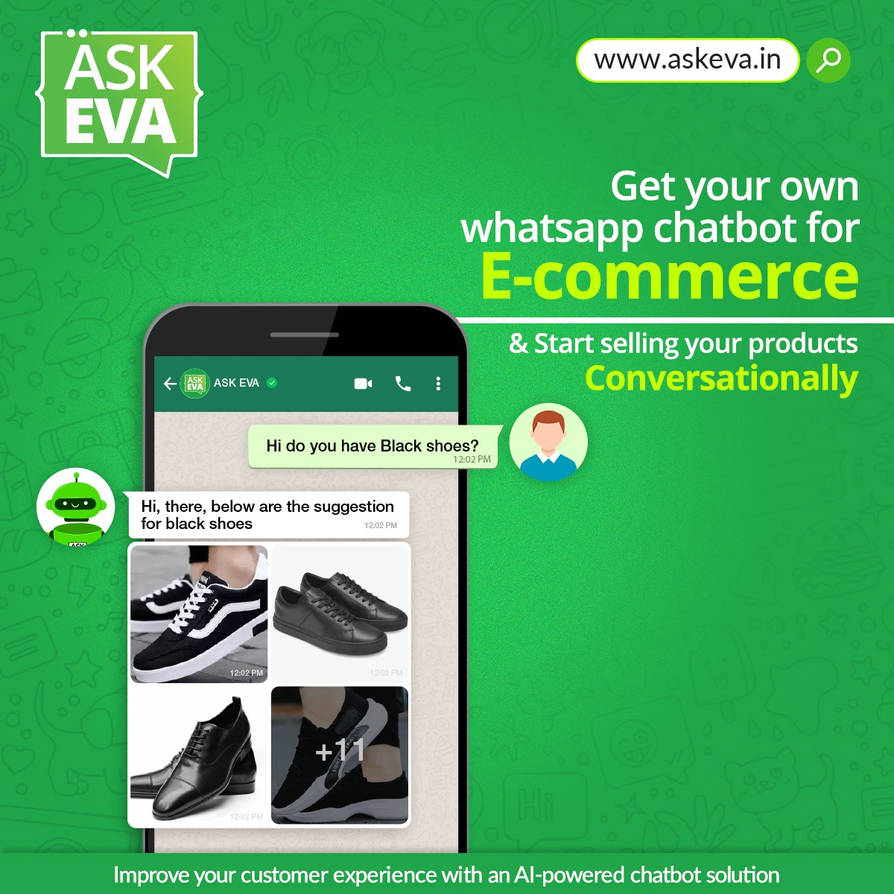

As the insurance industry continually evolves to meet customer demands, WhatsApp chatbots have become a pivotal tool for enhancing service quality and efficiency. Leveraging the WhatsApp Business API, insurance providers can streamline customer communication, manage claims, support policyholders, and offer instant assistance—all through a platform with over 2 billion users worldwide. With Askeva’s tailored WhatsApp chatbot solutions, insurance companies can not only improve customer satisfaction but also automate essential processes, saving time and resources.

Key Benefits of WhatsApp Chatbots for the Insurance Sector

1. Instant Customer Support

Insurance clients often need immediate answers regarding policy details, coverage, premiums, or claim status. With a WhatsApp chatbot from Askeva, insurers can provide 24/7 customer support, quickly addressing frequent queries. These chatbots can be configured to handle numerous questions simultaneously, ensuring customers get fast and accurate responses anytime, from anywhere.

2. Streamlined Claims Processing

One of the most time-consuming aspects of insurance is the claims process. Askeva’s WhatsApp chatbot solutions simplify this by guiding customers through claim submissions, collecting necessary documentation, and providing real-time status updates. This minimizes the back-and-forth that traditionally occurs, enhancing transparency and improving customer trust in the claims process.

3. Enhanced Policy Management

For policyholders, managing policies can be complex. WhatsApp chatbots make it simple for customers to review, renew, or upgrade their policies directly through the app. Askeva’s chatbots integrate with internal insurance systems, allowing users to manage their policies seamlessly, request information on premium payments, or even access digital policy documents.

4. Lead Generation and Customer Retention

Insurance companies are always seeking ways to expand their client base while maintaining relationships with existing customers. Chatbots can be used to nurture leads, provide quotes, and follow up on inquiries. Askeva’s solutions are designed to engage potential clients with targeted offers or policy suggestions based on customer interactions. Additionally, reminders for policy renewals or new product offerings can be sent automatically, improving retention rates.

5. Personalized Recommendations and Risk Assessments

Through intelligent data analysis, WhatsApp chatbots can analyze customers’ previous interactions and preferences, enabling insurers to provide personalized policy recommendations. For instance, by assessing a client’s lifestyle and existing coverage, a chatbot could suggest additional coverage or a specialized policy. Askeva’s chatbots can even perform preliminary risk assessments, giving customers an idea of the coverage they might need.

Practical Applications of Askeva’s WhatsApp Chatbot Solutions in Insurance

Quotation and Premium Calculation

Potential customers can interact with the WhatsApp chatbot to request quotes for various insurance plans. By collecting basic information like age, coverage type, and other relevant details, the chatbot can calculate and provide a premium estimate within minutes. This eliminates the need for long forms and waiting periods, enhancing customer convenience and satisfaction.

Claim Filing and Tracking

Filing claims can be a daunting task for policyholders. Askeva’s chatbot guides users through each step, from initial documentation submission to the final resolution, ensuring they stay informed at every stage. This includes notifying them of any additional required documents or updates, minimizing frustration and uncertainty in the claims process.

Renewal Reminders and Notifications

Policy renewals are essential for maintaining uninterrupted coverage. With Askeva’s chatbot, customers receive automated reminders about upcoming renewals, and they can complete the renewal process within WhatsApp. This reduces the risk of policy lapses and offers a convenient, timely reminder for clients who may otherwise forget or delay their renewals.

Cross-Selling and Up-Selling Opportunities

Chatbots can identify and act on up-sell and cross-sell opportunities based on customers’ current policies and lifestyle needs. If a customer inquires about travel insurance, the chatbot could suggest adding health or accident insurance as well. Askeva’s intelligent algorithms analyze each interaction to ensure clients receive value-added services that are relevant and timely.

Fraud Detection and Prevention

Fraud is a prevalent challenge in the insurance industry, costing billions of dollars each year. Chatbots play a role in fraud detection by tracking unusual patterns and verifying client details. Suspicious claims or discrepancies in documentation can be flagged and reported, helping to minimize the risk of fraud. Askeva’s chatbots integrate advanced security features to protect data and improve fraud detection.

Why Choose Askeva for Your WhatsApp Chatbot Needs in Insurance?

Askeva specializes in developing customized WhatsApp chatbot solutions specifically tailored to the needs of insurance companies. Our chatbots are designed with user experience and regulatory compliance in mind, ensuring that all customer interactions are secure, efficient, and valuable.

Key features of Askeva’s insurance chatbots include:

- Easy Integration: Our chatbots integrate seamlessly with your CRM and policy management systems.

- Data Security: We prioritize the confidentiality of client data with encryption and compliance with data protection laws.

- Customizability: Each chatbot is tailored to your company’s unique needs and customer base.

- 24/7 Support: We provide ongoing support to ensure your chatbot stays updated and functional.

By partnering with Askeva, insurance companies can take their customer service to the next level, offering the speed, convenience, and security that modern consumers expect.

FAQs about WhatsApp Chatbot Solutions for Insurance

1. What are the benefits of using a WhatsApp chatbot in the insurance industry?

A WhatsApp chatbot offers instant, round-the-clock support, simplifies claim processing, enhances customer engagement, and reduces operational costs by automating repetitive tasks.

2. How does a WhatsApp chatbot handle policy renewals?

Askeva’s chatbot sends automated reminders to clients regarding upcoming renewals. Customers can then complete the renewal directly within WhatsApp, simplifying the process and preventing potential policy lapses.

3. Can a chatbot help detect fraud in insurance claims?

Yes, chatbots can identify unusual patterns, verify client information, and flag suspicious claims. Askeva’s chatbots come equipped with security features to support fraud detection and prevention efforts.

4. Is my customer data safe with a WhatsApp chatbot?

Absolutely. Askeva adheres to strict data protection protocols, ensuring all customer information is encrypted and secure in compliance with industry standards.

5. How do chatbots assist in generating insurance leads?

Chatbots can engage potential clients by providing instant quotes, following up on inquiries, and suggesting policy options based on the user’s needs. This keeps prospects engaged and enhances lead conversion.

6. What makes Askeva’s WhatsApp chatbot solutions unique for the insurance industry?

Askeva provides highly customized chatbot solutions tailored to the insurance sector, with features like CRM integration, secure data handling, and advanced AI capabilities that improve user experience and operational efficiency.

7. Can the chatbot recommend insurance policies?

Yes, Askeva’s chatbot can analyze a client’s interactions and suggest policies or additional coverage options that align with their needs, enhancing personalization and customer satisfaction.

8. How does a chatbot streamline the claims process?

Askeva’s chatbot guides customers through each step of the claim submission, collects necessary documents, and provides real-time status updates, minimizing delays and enhancing transparency.

By implementing Askeva’s WhatsApp chatbot solutions, insurance companies can create a seamless, efficient, and customer-centric experience. Whether it’s simplifying the claims process, generating leads, or boosting customer engagement, a well-designed chatbot offers endless potential to improve and modernize insurance services.