In the fast-paced world of financial trading, the journey to true success is often elusive. Many traders seek out sophisticated tools and platforms to gain an edge, and Meta Traderz has emerged as a premier choice. This article delves into the strategies and practices that can help traders achieve enduring success using Meta Traderz.

Understanding Meta Traderz

Meta Traderz is a robust trading platform known for its comprehensive features, user-friendly interface, and powerful analytical tools. It supports various financial instruments, including forex, commodities, and cryptocurrencies. To build true success with Meta Traderz, traders need to master its functionalities and apply disciplined trading strategies.

Key Steps to Building Success with Meta Traderz

1. Education and Knowledge

The foundation of successful trading with Meta Traderz begins with education. Traders must familiarize themselves with the platform’s features, including charting tools, indicators, and automated trading capabilities.

Actions:

- Take Courses: Enroll in online courses or attend webinars focused on Meta Traderz.

- Read Manuals and Guides: Study the official documentation and user guides.

- Follow Market News: Stay updated with financial news and market trends.

2. Developing a Trading Plan

A well-structured trading plan is essential. This plan should outline your trading goals, risk tolerance, and strategies.

Components of a Trading Plan:

- Objectives: Define clear, achievable goals.

- Risk Management: Establish risk limits for each trade and your overall portfolio.

- Trading Strategies: Detail the specific strategies you will use, including entry and exit points.

3. Practicing with a Demo Account

Before risking real money, use Meta Traderz’s demo account feature to practice trading. This allows you to test your strategies and get comfortable with the platform without financial risk.

Benefits of a Demo Account:

- Risk-Free Practice: Learn from mistakes without losing money.

- Strategy Testing: Evaluate the effectiveness of different trading strategies.

- Platform Familiarity: Become proficient in navigating and using the platform’s tools.

4. Utilizing Technical Analysis

Meta Traderz offers a wide range of technical analysis tools, including charts, indicators, and expert advisors (EAs). Effective use of these tools can significantly enhance your trading performance.

Key Technical Analysis Tools:

- Charts: Use line, bar, and candlestick charts to visualize market trends.

- Indicators: Apply indicators like Moving Averages, RSI, and MACD to identify trading opportunities.

- EAs: Develop or purchase expert advisors for automated trading based on predefined criteria.

5. Implementing Risk Management

Risk management is crucial to long-term trading success. Meta Traderz provides various features to help manage risk, such as stop-loss and take-profit orders.

Risk Management Techniques:

- Stop-Loss Orders: Set stop-loss orders to automatically close a position at a predetermined loss level.

- Take-Profit Orders: Use take-profit orders to secure profits when a target price is reached.

- Position Sizing: Calculate appropriate position sizes based on your risk tolerance and account balance.

6. Continuous Learning and Adaptation

The financial markets are dynamic, requiring traders to continuously adapt and improve their strategies. Regularly reviewing your trades and staying informed about market developments is essential.

Continuous Improvement Strategies:

- Review and Reflect: Analyze your past trades to identify strengths and weaknesses.

- Stay Informed: Keep up with economic news, market trends, and new trading strategies.

- Seek Feedback: Engage with trading communities and mentors for advice and insights.

7. Emotional Discipline

Emotional discipline is a critical aspect of trading success. Traders must manage their emotions and avoid impulsive decisions driven by fear or greed.

Tips for Emotional Discipline:

- Stick to Your Plan: Follow your trading plan diligently, even during market volatility.

- Take Breaks: Step away from trading when feeling overwhelmed or stressed.

- Maintain a Trading Journal: Document your trades and emotions to identify patterns and improve discipline.

Conclusion

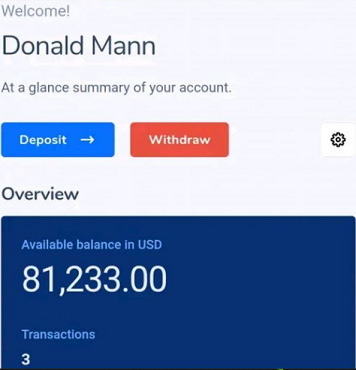

Building true success with Meta Traderz involves a combination of education, planning, practice, and disciplined execution. By mastering the platform’s features, developing a solid trading plan, utilizing technical analysis, managing risk effectively, and maintaining emotional discipline, traders can enhance their chances of achieving long-term success in the financial markets. Remember, continuous learning and adaptation are key components of staying ahead in the ever-evolving world of trading. Open up a NEW account. Put funds into your NEW account. Once your your NEW account is funded. You qualify for a new members bonus of $200 dollars. Click Here to start building your success with MetaTraderz today.