In this article we will discuss about the conversion of private limited company to LLP, Bolting change of Private Limited Company (PLC) to Limited Liability Partnership (LLP) has become the trend among the business owners who looked forward to more freedom, less regulation, and taxes. This guide covers the various benefits that come with conversion, the process for the switch and the necessary documents needed.

Why Convert a Private Limited Company to an LLP?

Private limited companies offer structured governance and investor appeal. However, some PLCs choose to convert to LLPs to enjoy reduced compliance obligations, tax savings, and simplified management structures. Here are the primary reasons:

- Tax Benefits: There is no tax on dividend distribution for LLPs and neither is there the minimum alternate tax, making for efficiency in tax on income distribution towards partners.

- Reduced Compliance: An LLP has less paperwork and filing obligations and compliance than a private limited company.

- Flexibility: In another note, LLPs are much better in terms of operational flexibility compared to PLC since the latter has rigid capital contribution criteria.

- Limited Liability Protection: Similar to private limited companies the partners of an LLP are not personally liable for the debts or losses of the firm or their personal assets are at risk.

Pre-Requisites for Conversion

Before beginning the conversion process from a private limited company to an LLP, certain conditions must be met:

- Approval of Existing Members: All the shareholders of the private limited company need to give their consent in order to make such conversion.

- Minimum Partners: An LLP can have only two designated partners, out of which at least one has to be an Indian citizen.

- Compliance Record: Private limited company must be in a good standing with compliance, with no filing or default in due course.

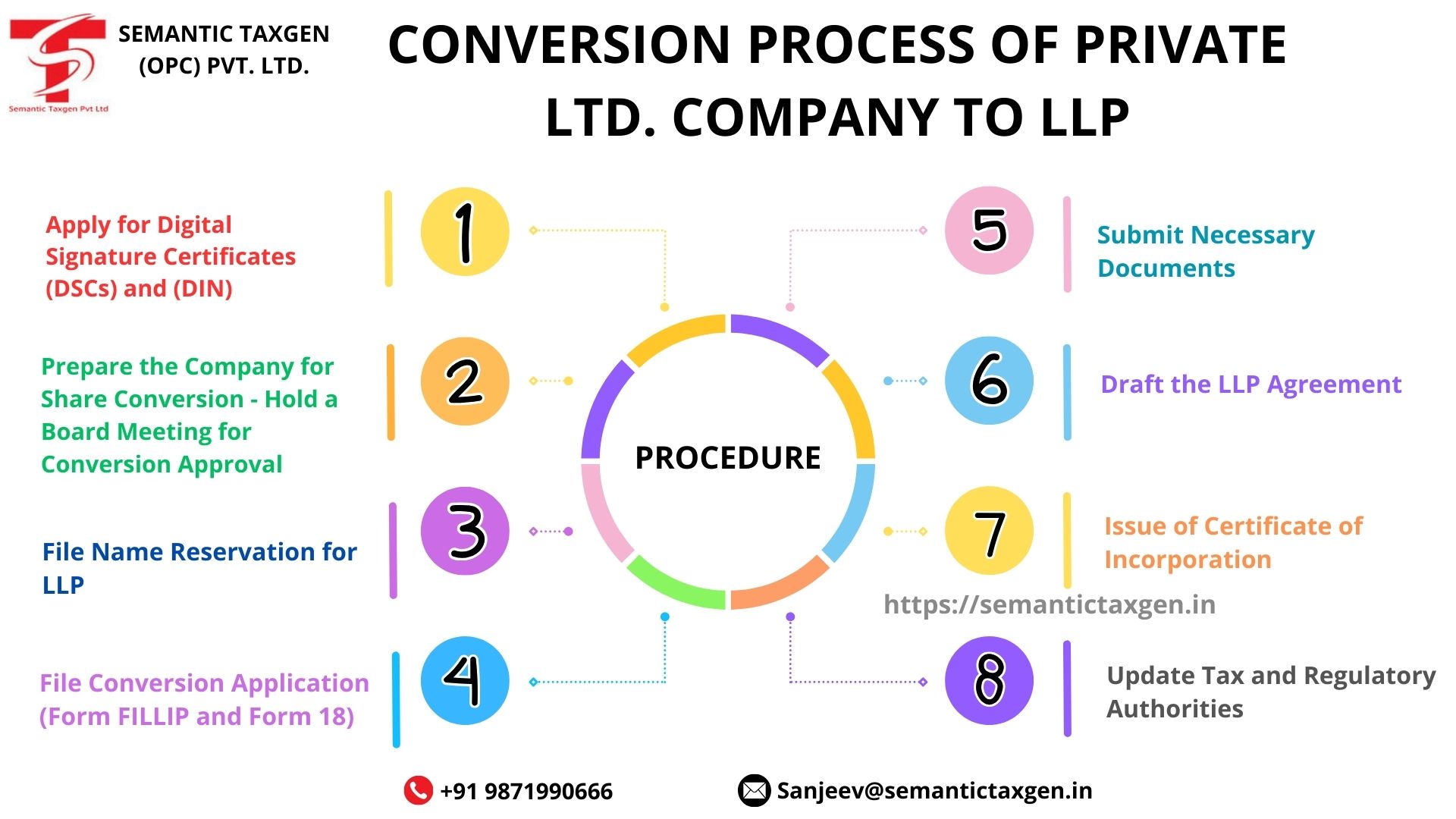

Detailed Process Involved in Conversion from Private Limited Company to LLP

Step 1: After, apply for the Digital Signature Certificates (DSCs) and Director Identification Number (DIN).

As per the above said rules and regulations each of the nominated partner in the LLP should have Digital Signature Certificate (DSC) and Director Identification Number (DIN) compulsorily. This is required for signing forms electronically.

Step 2: Minutes 6: Prepare the Company for Share Conversion Holding a Board Meeting for Conversion Approval

Converting the private limited company will require a board meeting where the directors approve the procedure and one of them to make application to the requisite application. A resolution approving the conversion should be passed and recorded.

Step 3: File Name Reservation for LLP

File for name reservation with the Ministry of Corporate Affairs (MCA) through Form LLP-RUN (Reserve Unique Name). You may retain the name of the private limited company if available.

Step 4: File Conversion Application (Form FILLIP and Form 18)

File Form (Form for Incorporation of LLP) and Form 18 (Application for conversion from private limited company to LLP) with the Registrar of Companies (ROC). Form 18 specifically outlines that the PLC is being converted to an LLP, requiring company details and shareholder consent.

Step 5: Submit Necessary Documents

The following documents must be submitted to support the application:

- Consent of all shareholders for the conversion

- Incorporation documents of the existing private limited company

- Latest income tax returns and acknowledgment

- Consent from secured creditors (if any)

- Certified copies of all statutory registers and company records

Step 6: Draft the LLP Agreement

Open a company to prepare LLP agreement in which role, responsibility and profit sharing ratio of partners are to be provided. It needs to be registered within one month of obtaining the Certificate of Incorporation of LLP.

Step 7: Issue of Certificate of Incorporation

Upon verification, the ROC will issue the Certificate of Incorporation for the LLP. This certificate confirms the conversion of the private limited company to an LLP.

Step 8: Update Tax and Regulatory Authorities

It has also been found to be beneficial that after converting from an Indian company to an LLP, the same should inform the Income Tax Department, GST authorities, and banks about the change. Such record can never be out of date and it is necessary to update such records to avoid any hitches in the operation. Learn More